2020 CARES Act and Tax Credit is OFFICIAL!

Who is eligible:

![]() U.S residents and citizens

U.S residents and citizens

![]() Taxpayers not claimed by another person

Taxpayers not claimed by another person

![]() Taxpayers with SSN and authorized to work in U.S

Taxpayers with SSN and authorized to work in U.S

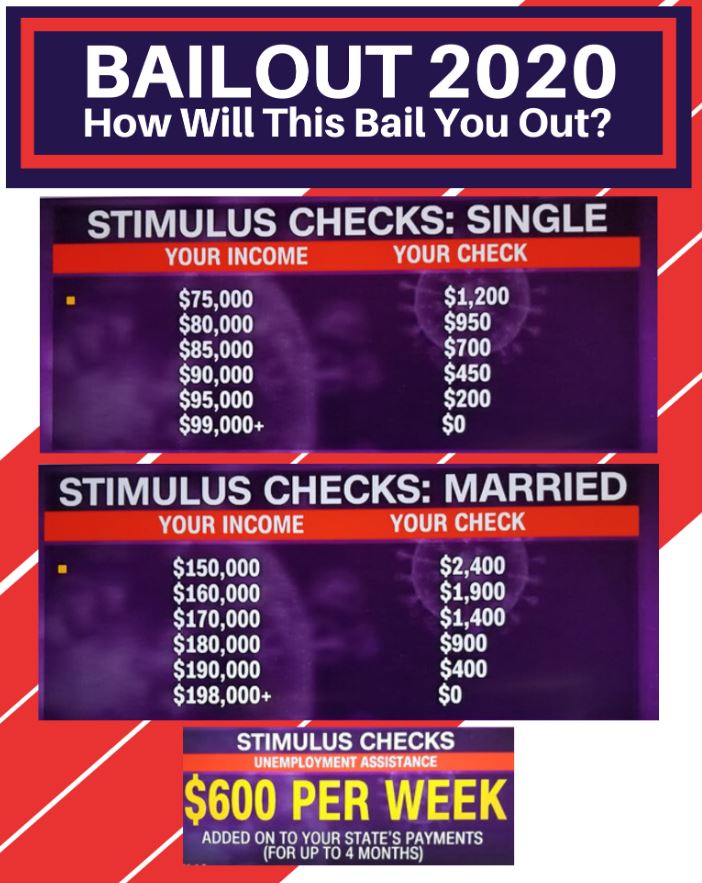

Economic Stimulus Check Summary:

![]() IRS will issue checks based on 2019 tax information if you filed a tax return, if you haven’t filed yet, they will use 2018 tax information.

IRS will issue checks based on 2019 tax information if you filed a tax return, if you haven’t filed yet, they will use 2018 tax information.

![]() If you had lower income in 2019 and haven’t filed, it’s a good idea to file soon. If you haven’t filed 2019, 2018, 2017, 2016, 2015, 2014 tax returns email me ASAP!

If you had lower income in 2019 and haven’t filed, it’s a good idea to file soon. If you haven’t filed 2019, 2018, 2017, 2016, 2015, 2014 tax returns email me ASAP!

![]() Direct deposits is still the fastest and easiest way to distribute funds. However, the IRS will also mail checks

Direct deposits is still the fastest and easiest way to distribute funds. However, the IRS will also mail checks![]()

![]() The economic stimulus check is non-taxable income

The economic stimulus check is non-taxable income![]()

![]() 65+ year olds will continue receiving their social security benefits and they will also receive the economic stimulus check

65+ year olds will continue receiving their social security benefits and they will also receive the economic stimulus check![]()

![]() The economic stimulus Corona Coins will be distributed next month since, it was approved by Senate, the House and the President signed it TODAY.

The economic stimulus Corona Coins will be distributed next month since, it was approved by Senate, the House and the President signed it TODAY.

The government economic plan is that Americans will spend ![]()

![]()

![]()

![]()

![]()

![]() thees funds and get the economy back on track

thees funds and get the economy back on track![]()

Need more information visit: https://www.nytimes.com/article/coronavirus-stimulus-package-questions-answers.html

Need tax returns efiled call 470-312-7693 or email caroline@carokimcpaconsulting.com

#thanksTrump#irs#economicstimuluscheck#taxes#taxrefund#tax#taxreturn#taxpreparer#taxpreparation#coronacoins#coronavirus #CARESACT

🙅♀️

🙅♀️

On December 20, 2019, President Trump signed into law the Appropriations Act of 2020, which included a number of tax law changes, including extending certain tax provisions that expired after 2017 or were about to expire, a number of retirement and IRA plan modifications, and other changes that will impact a large portion of U.S. taxpayers as a whole. This article is one of a series of articles dealing with those changes and how they may affect you.

On December 20, 2019, President Trump signed into law the Appropriations Act of 2020, which included a number of tax law changes, including extending certain tax provisions that expired after 2017 or were about to expire, a number of retirement and IRA plan modifications, and other changes that will impact a large portion of U.S. taxpayers as a whole. This article is one of a series of articles dealing with those changes and how they may affect you.