1. ECONOMIC STIMULUS FUNDS

2020 CARES Act and Tax Credit is OFFICIAL!

Article Overview:

- Who is and who isn’t eligible

- Economic stimulus amounts

- AGI phase-out and thresholds

- Stimulus funds disbursement timeline

Who Is Eligible:

![]() U.S residents and citizens

U.S residents and citizens

![]() Taxpayers not claimed on another person’s tax return

Taxpayers not claimed on another person’s tax return

![]() Taxpayers with SSN and authorized to work in U.S

Taxpayers with SSN and authorized to work in U.S

![]() Taxpayer filed a 2018 or 2019 tax return

Taxpayer filed a 2018 or 2019 tax return

Who Is Not Eligible

- Taxpayers who owe child support

- Immigrants without Social Security numbers

- College students and 17 year-olds

- Disabled people whose parents support them

- Seniors living with their kids

- High earners who lost their jobs

- Parents who split custody

- Recently divorced or estranged

- Babies born in 2020

Economic Stimulus Check Summary:

![]() IRS will issue checks based on 2019 tax information if you filed a tax return, if you haven’t filed yet, they will use 2018 tax information.

IRS will issue checks based on 2019 tax information if you filed a tax return, if you haven’t filed yet, they will use 2018 tax information.

If you had lower income in 2019 and haven’t filed, it’s a good idea to file soon. If you haven’t filed 2019, 2018, 2017, 2016, 2015, 2014 tax returns email me ASAP!

![]() Direct deposits is still the fastest and easiest way to distribute funds. However, the Internal Revenue Service will also mail checks.

Direct deposits is still the fastest and easiest way to distribute funds. However, the Internal Revenue Service will also mail checks.

![]() The economic stimulus check is non-taxable income.

The economic stimulus check is non-taxable income.

![]() 65+ year old will continue receiving their social security benefits, pension and they will also receive the economic stimulus check. “Social Security recipients will automatically get stimulus checks without filing taxes for 2018 or 2019”, Treasury says.

65+ year old will continue receiving their social security benefits, pension and they will also receive the economic stimulus check. “Social Security recipients will automatically get stimulus checks without filing taxes for 2018 or 2019”, Treasury says.

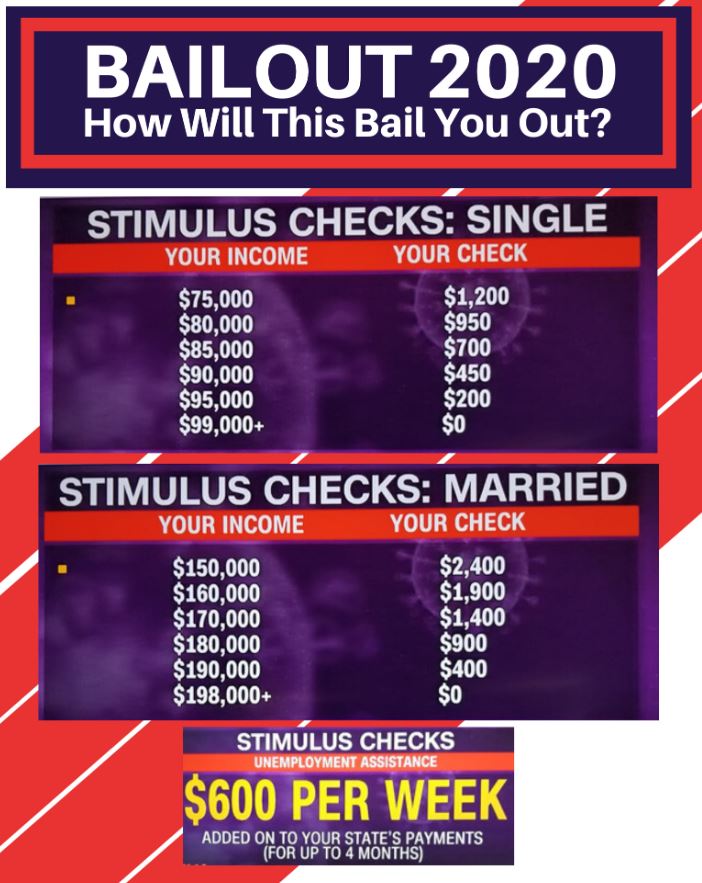

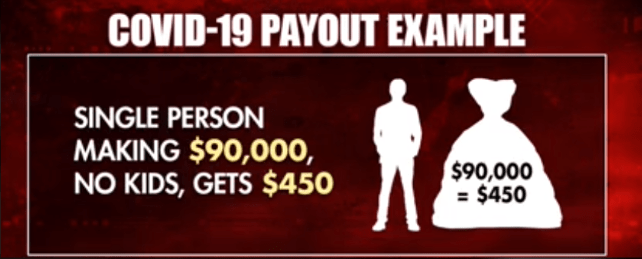

Economic Stimulus Funds For Individuals:

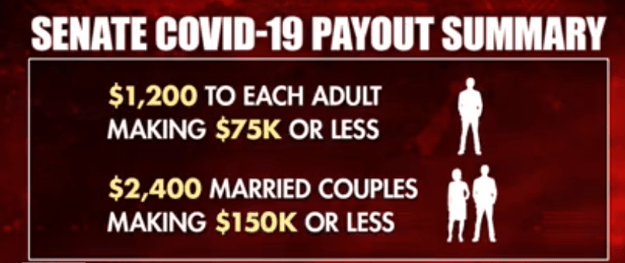

- $1,200 check for single or head of household income tax filers and $2,400 for married filing joint tax filers.

- $500 per child claimed on the latest income tax return filed with IRS.

$1,200 for single filers and $2,400 for joint filers depends on the taxpayers Adjusted Gross Income (AGI is line 8b of your 2019 1040) and not total income per taxpayers W2.

Again, if you haven’t filed 2019 tax return, the Internal Revenue Service will use your 2018 income tax return and bank information.

Income Limitations And Thresholds:

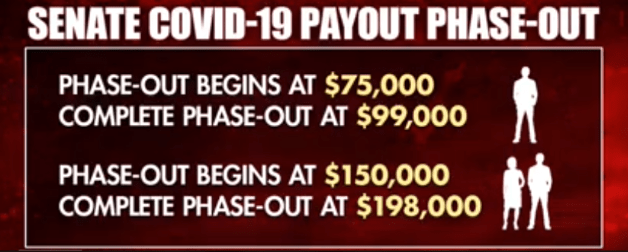

You get the full amount if your Adjusted Gross Income – AGI is below the following phase-out and threshold amounts:

- $75,000 for single tax filers

- $150,000 for married filing joint tax filers

- $112,500 for heads of households tax filers

$1,200 for single and 2,400 for married filing joint tax filers above is reduced by $5 for each $100 that a taxpayer’s AGI exceeds the threshold amount.

You won’t get the stimulus check if your AGI is above the following amounts:

- $99,000 for single tax filers

- $198,000 for joint tax filers

- $146,500 for heads of households tax filers

Economic Stimulus Funds Timeline

- If direct deposit information was provided to the IRS, you will receive payments starting mid-April – most likely the week of April 13.

- If direct deposit information was not provided to the IRS, wait about three weeks after direct deposits go out. The IRS will start issuing paper checks most likely the week of May 4.

The US government CARES economic program and plan is that Americans will spend ![]()

![]()

![]()

![]()

![]()

![]() these funds and get the economy back on track

these funds and get the economy back on track![]()

To learn more visit: https://www.nytimes.com/article/coronavirus-stimulus-package-questions-answers.html