‘Mkono wa serikali ni mrefu’ is a Swahili saying that means the governments’ hand is long.

1️⃣ If you have unfiled tax returns, let’s strike up a conversation.

DON’T PROCRASTINATE! There is a three year statute of limitations on refunds and after it runs out, any refund due is forfeited.

2️⃣ If you have W2s it doesn’t always mean you will owe taxes, you have up to three years to claim your refund. This statute is three years from the due date of the tax return.

3️⃣ If you have back taxes owed, I can facilitate an IRS resolution via installment or relief plans.

4️⃣ If your books are not in order, I provide both accounting and bookkeeping services as well as audit compliance support.

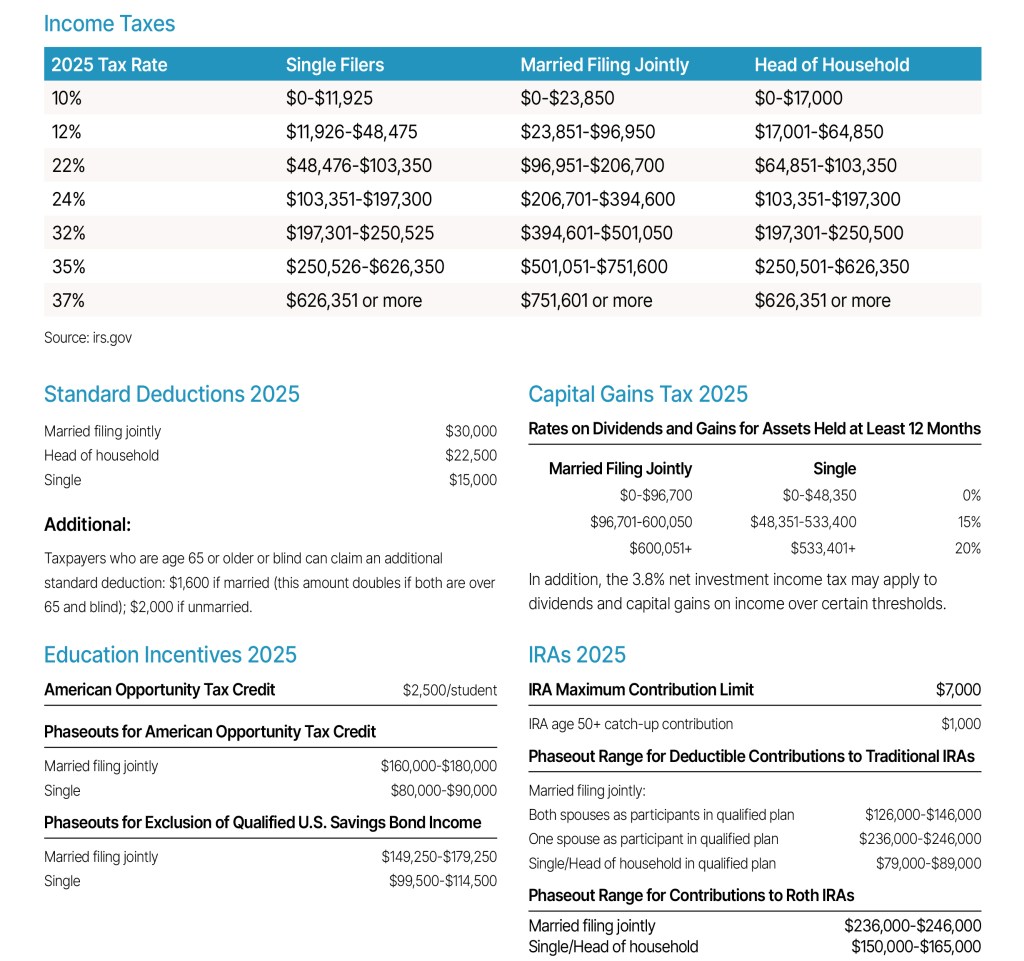

Filing is required when a taxpayer owes a penalty, even though the taxpayer’s income is below the filing threshold. Such as early withdrawal penalty or the 50% penalty for not taking a required IRA distribution.

5️⃣ If you do not have income to report or don’t want to file a return, I highly recommend you file one to get a refund of any federal income tax withheld. You may also be eligible for a refund from any of the following credits.

- Withholding refund – A substantial number of taxpayers fail to file their return even when the tax they owe is less than their prepayments, such as payroll withholding, estimates, or a prior overpayment. The only way to recover the excess is to file a return.

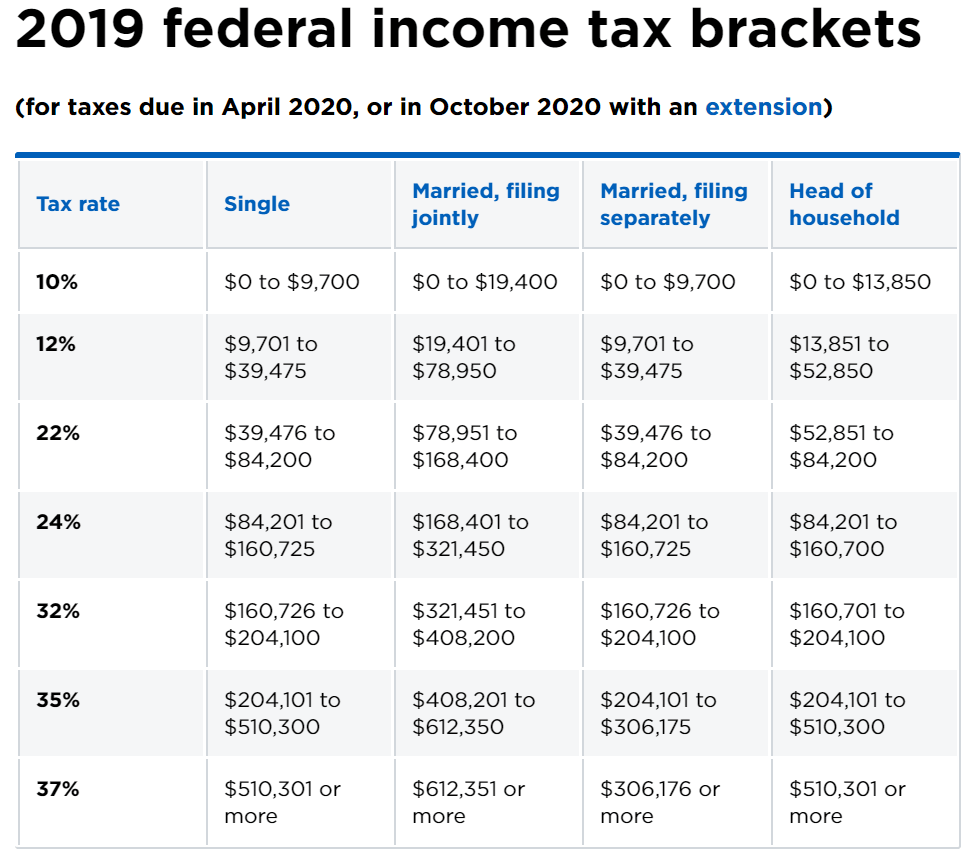

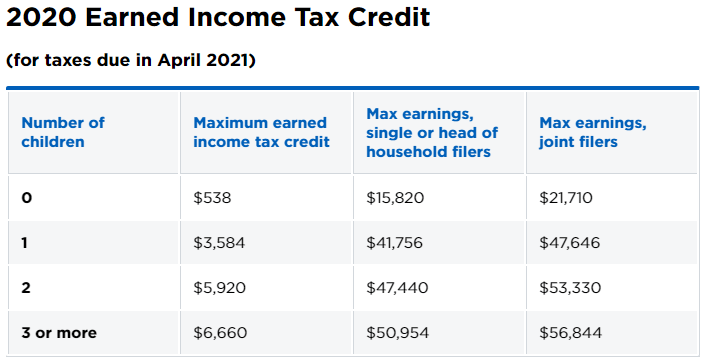

- Earned Income Tax Credit (EITC) – If you worked and did not make a lot of money, you may qualify for the EITC. The EITC is a refundable tax credit, which means you could qualify for a tax refund. The refund could be as high as several thousand dollars even when you are not required to file.

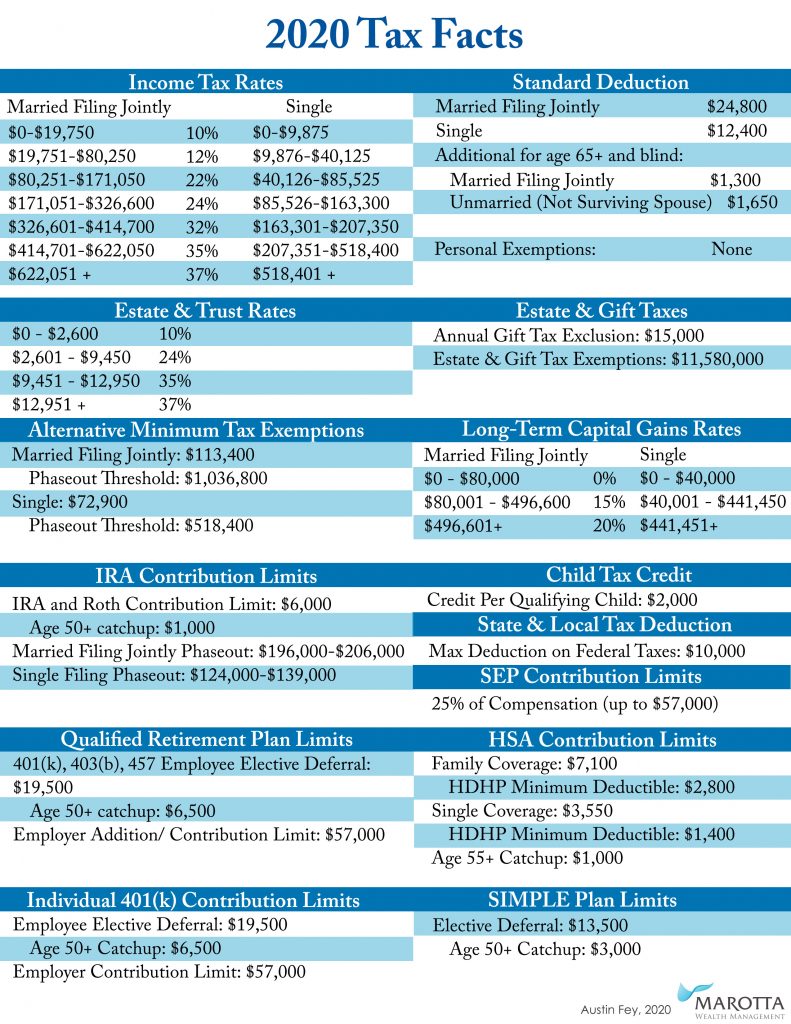

- Child Tax Credit – This is a $2,000 credit for each qualifying child, a portion of which may be refundable for lower income taxpayers, and phases out for higher income taxpayers.

- American Opportunity Credit – The maximum for this credit for college tuition paid per student is $2,500, and the first four years of postsecondary education qualify. Up to 40% of the credit is refundable when you have no tax liability, even if you are not required to file.

- Premium Tax Credit – Lower-income families are entitled to a refundable tax credit to supplement the cost of health insurance purchased through a government Marketplace. To the extent the credit is greater than the supplement provided by the Marketplace, it is refundable even if there is no other reason to file.

- Credit for federal tax on fuels.

- Health coverage tax credit.

The government and financial institutions are waiting for you to need something from them, so that they can teach and show you how long their hands really are – the long arm of the law.

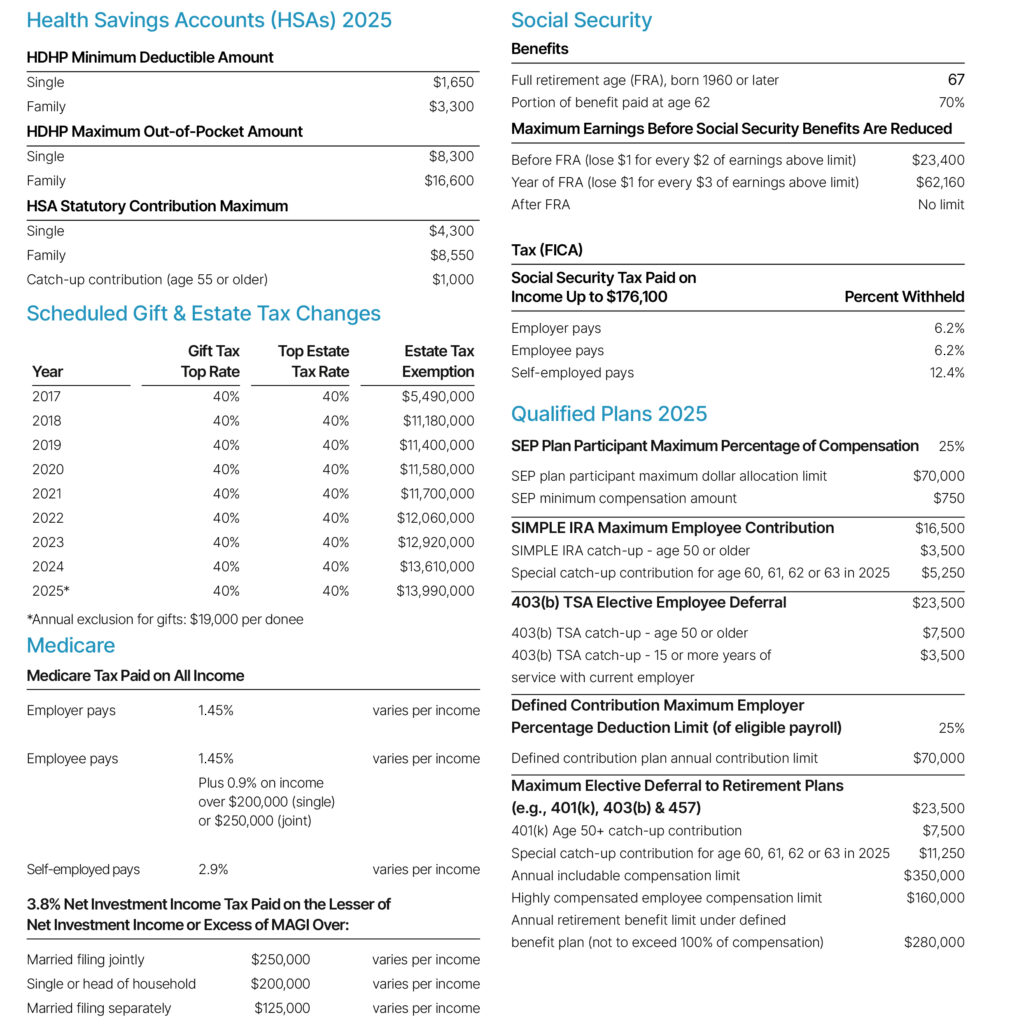

2025 Tax Facts

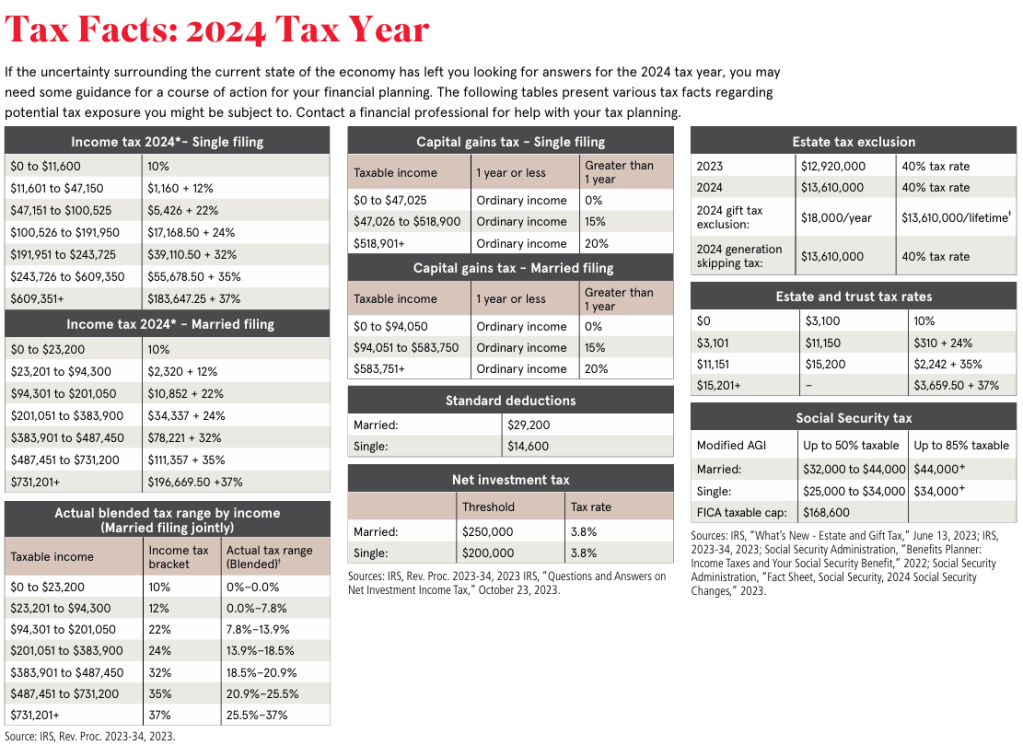

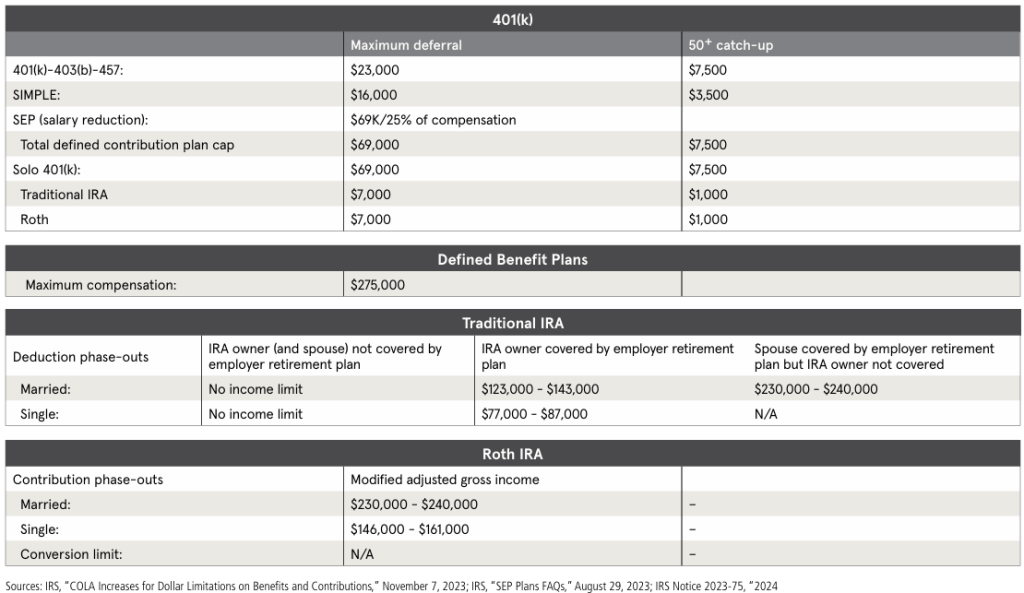

2024 Tax Facts